what happens to mortgage payments when the market crashes

How Stock Marketplace Crashes Affect the Housing Market

Wise investors build wealth through diversification, holding a mix of stocks, bonds, and existent manor in their portfolios. Diversification spreads hazard across investments that may have an inverse relationship, meaning that when one goes downwards, the other goes upward. Historically, although not always, when stocks go down, bonds rise, and vice versa. When bonds ascension, their interest rates fall. Simply the relationship of the stock market to real manor is somewhat less direct. How stock market place crashes impact the housing market has more to practise with what caused the crash in the showtime place, combined with other external weather like jobs and, most recently, a global pandemic.

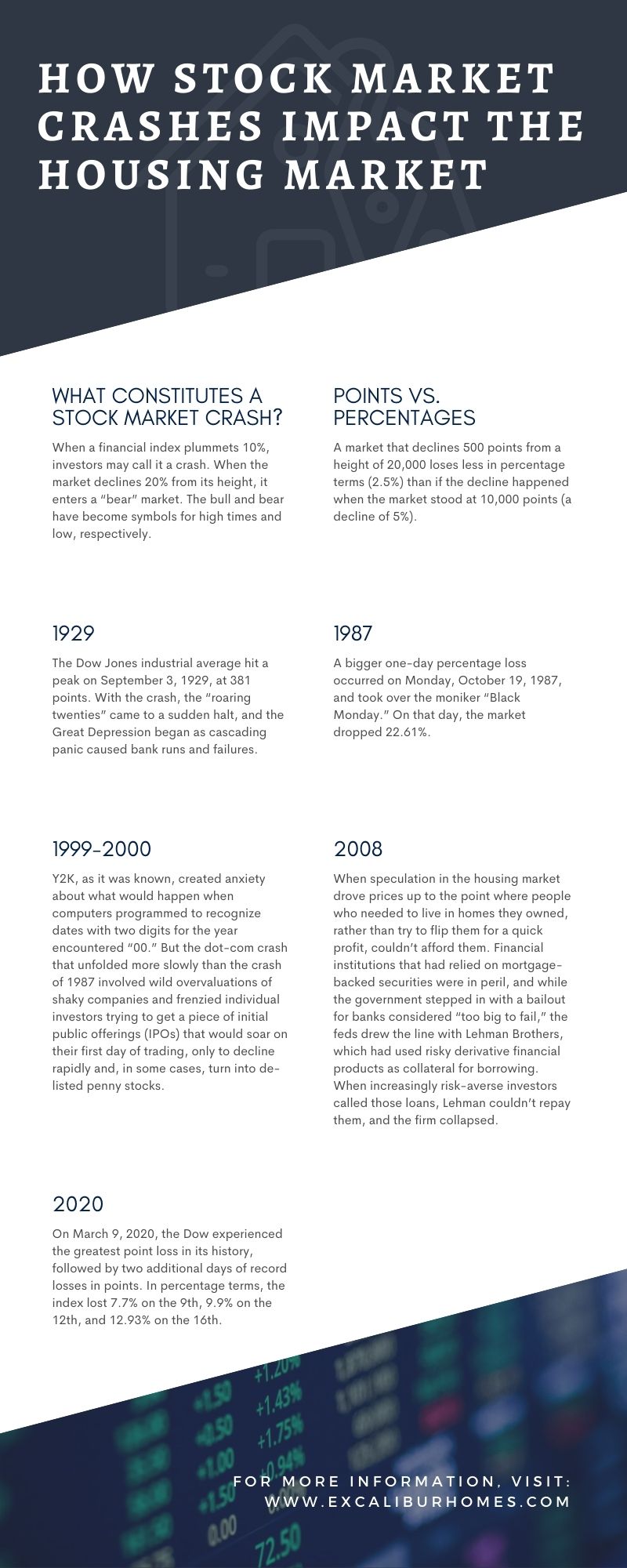

What Constitutes a Stock Market Crash?

When a fiscal index plummets ten%, investors may call it a crash. When the market declines 20% from its height, it enters a "bear" market place. The balderdash and carry accept get symbols for loftier times and low, respectively. A bull market is one that just keeps going upward, but all investors know that what goes upwards must come down, eventually—and when stocks come downwards a lot, investors sell more speculative investments and plow to "defensive" stocks and other investments that tend to concur their value through difficult economic conditions.

Real estate, it would seem, should fall into the "defensive investment" category. Afterwards all, people volition always need a place to alive. But their willingness to buy or sell a home, and their ability to pay a mortgage or beget rent, fluctuates with overall economic conditions—including, but non express to, the stock market.

Points vs. Percentages

Information technology is important to understand the difference betwixt stock market place "points" and pct gains and losses. A market that declines 500 points from a height of 20,000 loses less in percentage terms (2.5%) than if the decline happened when the market stood at 10,000 points (a pass up of v%). Thus, when the daily news headlines scream that "the Dow lost 750 points today," that may sound like a huge decline, but to understand the potential impact of the reject, expect to the pct loss.

Crashes sometimes extend over several days as investors begin to panic and sell into the loss, causing farther declines.

1929

As the most famous crash in U.Southward. history, the 1929 stock market meltdown saw declines of 13% on October 28, 1929, the first "Black Monday," followed by another pass up of 12% on "Black Tuesday," October 29, 1929. The Dow Jones industrial boilerplate striking a peak on September 3, 1929, at 381 points. With the crash, the "roaring twenties" came to a sudden halt, and the Smashing Low began equally cascading panic caused banking company runs and failures.

Historians signal to overconfidence from the booming economy of the '20s, the abundance of easy credit and ownership on "margin" (borrowing to finance investments), an oversupply of appurtenances and agricultural products, and a sudden increase in involvement rates every bit primary causes of the crash. Many people who couldn't afford to lose, lost everything they had, including their jobs and their homes. This led to a prolonged slump in housing prices—only one role of the overall economic disaster that was the Peachy Depression.

1987

A bigger one-day pct loss occurred on Monday, October xix, 1987, and took over the moniker "Black Monday." On that day, the market dropped 22.61%. Speculation, margin, and highly leveraged corporate buyouts and takeovers built on shaky financing vehicles like junk bonds, all played a role. The crash of 1987 was the outset fourth dimension computerized trading played a part in accelerating selling and related losses. Market place leaders imposed "circuit breakers" that could stop trading if it got out of control. The market recovered from this loss relatively quickly. Investors did turn to defensive bonds, causing bond prices to rise and interest rates to autumn, making mortgages cheaper. Fewer individual investors felt the effects of the crash of 1987, and the real manor marketplace was only temporarily and regionally (as in New York City commercial real estate) impacted.

1999-2000

Y2K, as it was known, created feet near what would happen when computers programmed to recognize dates with 2 digits for the year encountered "00." But the dot-com crash that unfolded more slowly than the crash of 1987 involved wild overvaluations of shaky companies and frenzied individual investors trying to get a slice of initial public offerings (IPOs) that would soar on their first twenty-four hour period of trading, only to decline rapidly and, in some cases, plough into de-listed penny stocks. Most of those individual investors, however, were wealthy people who could endure the loss. The bursting of the dot-com bubble had niggling effect on ordinary retail investors, as they plant themselves locked out of participating in the speculative nail in the first place.

2008

Unlike the dot-com boom of 2000, the housing bubble that burst in 2007-2008 hit lower-income people the hardest. Easy credit and subprime lending played a big part. No-documentation loans made to people who couldn't beget them and may not have understood the impact of the financial obligation they were taking on were then packaged into "mortgage-backed securities." When speculation in the housing market drove prices up to the betoken where people who needed to live in homes they owned, rather than endeavour to flip them for a quick profit, couldn't afford them. Housing prices began a decline in 2007, and people who took out loans they couldn't afford began to default. This, in plough, affected the value of mortgage-backed securities, turning them into junk investments. Financial institutions that had relied on mortgage-backed securities were in peril, and while the government stepped in with a bailout for banks considered "too big to fail," the feds drew the line with Lehman Brothers, which had used risky derivative financial products as collateral for borrowing. When increasingly risk-averse investors called those loans, Lehman couldn't repay them, and the house complanate.

2020

On March 9, 2020, the Dow experienced the greatest point loss in its history, followed past ii additional days of record losses in points. In percentage terms, the alphabetize lost 7.7% on the ninethursday, 9.9% on the 12th, and 12.93% on the 16thursday. The market has continued to swing with corking volatility, and recent data for the 2nd quarter of 2020 indicates the worst turn down in gross domestic product (GDP) always recorded—nearly 35%. The March declines were fueled in function by merchandise wars, but much more past the impact of the coronavirus pandemic. Record unemployment, bankruptcies, and a big drop in demand for oil all signal a possible major recession.

The jury is still out on how the stock market volition impact the housing market in 2020. Some suburban areas take seen a housing boom as buyers with ways abscond loftier-density cities in pursuit of single-family homes with yards and plenty of space. At the same time, people who might take been considering selling their homes are delaying listing them, reducing supply. Stock markets and housing markets are affected by consumer confidence, involvement rates, and lending requirements. In the COVID-19 crisis, some businesses like hospitality and airlines and their workers have suffered badly, while some tech industries that carried on seamlessly while employees worked from abode posted gains.

Real estate investors in markets like Atlanta, with a higher population of tech and professional workers and industries, should weather this crisis with stable tenants who can keep paying hire. Suburban markets will meet involvement from buyers and renters fleeing dense population centers for broad-open up spaces, as they realize they don't take to live in the urban center to piece of work from home. Rental property management companies in Atlanta and real manor agents tin can assistance eager tenants detect available homes and help investors buy or sell income backdrop. Services include screening tenants, collecting rents, and taking care of maintenance through economic downturns as well as the good times.

Source: https://www.excaliburhomes.com/how-stock-market-crashes-impact-the-housing-market/

0 Response to "what happens to mortgage payments when the market crashes"

Postar um comentário